Renting vs Buying

Renting vs Owning

Buying your first home will be one of the biggest financial decisions of your life, but there are a ton of great long term benefits to owning a home rather than renting.

So how do you know when it’s time to buy?

You Should Rent

I plan to live in the area for less than 2 years.

I plan to stay

flexible.

I need to build my credit / repair credit history.

I’m saving money for a down payment.

You Should Buy

I plan to live in the area for more than 2 years.

I want to have freedom to customize my home.

I’m looking to save money with tax deductions.

I want to build

equity.

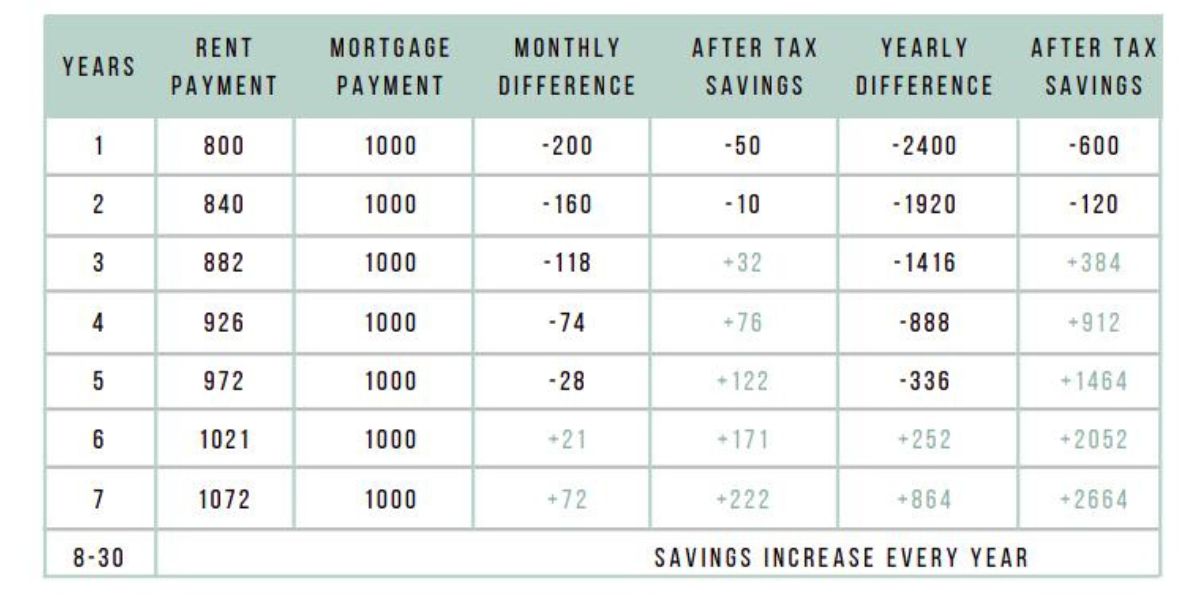

WHY IT PAYS TO BUY

To buy or to rent, that is the question. If it’s not in the cards for you right now, here are some reasons to start working towards homeownership.

Source: Ginnie Mae

WHY IT PAYS TO BUY

To buy or to rent, that is the question. If it’s not in the cards for you right now, here are some reasons to start working towards homeownership.

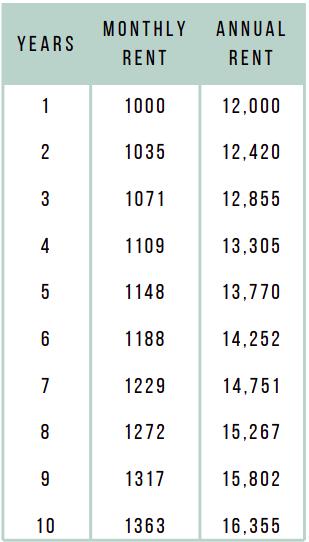

AVG. INCREASE 3.5% PER YEAR

SOURCE: NATIONAL ASSOCIATION OF

REALTORS®

$140,777 PAID IN RENT OVER TEN YEARS

With renting, that is $140,777 down the drain that you will never see again. Homeownership not only has tax advantages but as you pay down your mortgage loan and as home prices rise, your equity increases.